Get The Right Annuity Without A Sales Pitch

Confused about annuities? No need. Our unique Annuity Ranking System examines up to 1200 annuities for you. We make it easy for you to retire confidently. Hundreds of families have trusted local radio host, FIDUCIARY, and Certified Annuity Specialist® Steve Jurich. Call us. See how easy it is to schedule a free phone call, or a meeting in Scottsdale. For radio podcasts, click HERE.

Skip The Sales Pitch, Get The Facts.

Here's why you want to work with Scottsdale Financial Planner and Certified Annuity Specialist®, Steve Jurich (pronounced Jur-itch):

We are LOCAL. It's nice to know that you can hear your financial advisor on the radio every day (click HERE for podcasts). You can also read his best-selling book, SMART IS THE NEW RICH. The first three chapters of the book are available as an instant download.

Our firm is not an "annuity car lot." Unlike some firms, you are not handed over to a boiler room or sales people waiting on the floor for you to come in. We will take the time to help you and answer your questions, with respect and courtesy.

As a long standing family business with hundreds of clients, our goal is to help you incorporate your carefully considered annuity into a complete retirement financial plan, built to LAST.

Scottsdale Financial Planner Steve Jurich is one of America's leading annuity authorities and professional investment manager. Steve takes annuities apart and puts them back together for you--choosing only the best annuities for his personal clients. Our firm is an A+ Accredited Member of the Better Business Bureau, representing A+ carriers.

Annuity Critics--like the "Grumpy Old Billionaire" on TV who "Hates" Annuities (and thinks you should, too) are just trying to sell you something else. Billionaires don't need safe, secure income and protection from bear markets. But you do.

Every year, more retiring engineers, teachers, health care professionals, managers, lawyers, accountants, and tech workers choose annuities for all or part of their 401k, 403b & IRA rollovers. Why?

- Preservation of principal

- Certainty of income for 2 spouses from the same IRA

- More income than bond funds, with better safety

- A way to “buy a pension”, without “locking up” your money

- Strong diversification (non-correlated to stock market or real estate.)

Is your retirement income truly secure? If you are married, do you have an income plan in place for when one of you passes away? Securing retirement income for life-- for both you and your spouse-- is the single most important first step in financial planning for retirement. As more companies move away from pension plans to 401k plans, smart retirees are recognizing that --annuities are the practical way to get the benefits of a conservative investment combined with exceptional lasting income. Investing in retirement is complicated and risky. Today's NEXT GENERATION retirement annuities make life simple again. You stay in control of your principal while your income grows. You move up with your money, never down, forward never back. Many people want to skip the risk of the market and just collect paychecks (mailbox money). With the right annuity, you never experience a market loss. There is no management or advisor fee deducted from your principal. The insurance company does NOT keep your money when you die. Your heirs get everything you don't spend. You get lifetime income like a pension--without "annuitizing." Your principal continues to benefit from index gains, with no market losses. We're happy to help you compare annuities and share our years of research and experience with you. It won't cost you a penny to find out more--simply call us to schedule a free meeting in Scottsdale. Learn why hundreds of local families have chosen us to build their financial plans. (480)902-3333.

How do Annuities Work? Visit ANNUITY UNIVERSITY here...

Our goal is for you to stop worrying about your money.... Not because of "positive thinking", but because you have a disciplined, clearly laid out strategy proven to preserve your money, grow it, and keep paying you for life. Most plans put out by most advisors are based on pretty charts and past performance. But what about the future? What about all this debt we're taking on in Washington? What about Social Security? Will it always pay you what you expected it to? Will the markets perform in the future identically to the past? What if a crash comes at exactly the wrong time for you? Our "generous" Congress tends to bail out all kinds of people, but will they bail YOU out if your money runs down? (Not likely) With our approach, your income never lets you down. It is locked in AND guaranteed for LIFE. You use fewer dollars to a achieve that income because your income rate is typically 5% to 9% for life, depending on age and deferral period. This mathematical advantage leaves you far more money to invest for growth. Don't let your 401k "roll over and play dead". Move over to "Easy Street" at IQ Wealth-- and press the Easy button. Right now is the right time to put our trademarked strategy to work for you: Insure your income, insure your outcomes, invest the rest with purpose®

Limited Time!

Get Steve’s 2023

Ultimate Retirement Kit, FREE!

Instant Access To:

- 2023 Annuity Buyer’s Guide (61 pages of data and comparisons)

- Instructional videos

- First 3 Chapters of Steve’s Best Selling Book, Smart is the New Rich

- The 10 Minute Guide To Common Sense Retirement Planning

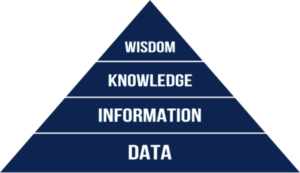

Does your Portfolio Have Too Much Risk? Or Not Enough?

Knowing your risk score can help you make appropriate investment choices.

Find out your risk score with our RiskAlyze tool!

By submitting your personal information, you consent to be contacted by a financial

professional regarding your financial strategy for retirement.

Video: The 5 Annuity Don'ts

All annuities are not alike, just as all homes and cars are not alike! In this short video, Steve makes it simple to understand annuities. You may want to take notes!

- Learn the 4 different types of annuities

- Learn how to compare annuities and their ratings

- Learn how to avoid disinheriting your heirs

- Learn which annuities cost the least and pay the most

- Learn how to keep it simple, avoid mistakes, and stay in control

> VISIT OUR LEARNING CENTER HERE

Honest Guidance, Straight Talk

What is an annuity? An annuity is an agreement with a regulated life insurance company to protect your money and pay you an income on the date you choose, like a pension. If you don't need income, your principal can grow tax deferred. An annuity is part pension, part investment, backed by insurance reserves. With the right annuity, the insurance company does NOT keep your money when you die. It can be a very smart 401k/IRA rollover. There are four types: immediate, variable, fixed, and fixed index. The Next Generation of Fixed Index annuities provides the most safety, security, principal protection, and lifetime income--when selected properly. Please don't buy annuities off the internet or from an agent who is really just a salesman--offering only one or two annuities. You owe it to yourself to learn how annuities work, the key differences between them, and which type of annuity is the right fit for your financial plan--without sales pressure.

This is 2022, not 1992: The annuities of old are a thing of the past.

Our unique process reviews up to 1200+ annuities. We help our clients with a fiduciary duty. And yes, we DO reject well over 98% of all annuities on the street. At this point in your life, you can't afford mistakes. Today--with the right annuity-- you may enjoy uncapped growth potential, no market losses, no management fees, ample liquidity, and safe, worry-free income for life in the range of 5% to 9.86% (or higher), depending on your age and deferral period. The insurance company does NOT keep your money when you die! Discover the NEXT GENERATION of retirement annuities today. VISIT ANNUITY UNIVERSITY HERE.

In founding MyAnnuityGuy.com, Steve’s mission was – and still is – to help his clients achieve their financial and lifestyle goals with more simplicity, less risk, more income, and more potential for upside growth. Is that what you want? We can help. MyAnnuityGuy is a service of IQ Wealth Management, a financial planning firm in Scottsdale, Arizona.

The company’s many satisfied clients include retired (and soon to retire) engineers, teachers, managers, technicians, and business owners who want to:

- Secure their retirement nest eggs while growing their income

- Build an income replacement plan that does not rely on market performance in order to succeed

- Provide guaranteed income for life, without annuitizing and without losing control

- Protect their heirs

- Maintain liquid access to their money

- Decrease the amount of taxes they pay, where-ever and whenever possible

- Lower their overall fees, expenses, and costs

Since 1996, Steve has built his practice around these three core principles:

- Honesty: No over-the-top sale pitches… just the facts. Period.

- Transparency: No hidden fees. No fine print without clear and easy to understand explanations. No mumbo-jumbo.

- Integrity: The company’s fiduciary duty is to their clients, not to a bank manager or a broker dealer.

Steve uses a unique process to review up to 1,200 annuities or more--playing no favorites-- giving his clients a critical advantage not found with most agents.

Steve is an Accredited Investment Fiduciary.

His company, IQ Wealth Management™, also provides clients with access to a number of proprietary annuities from major carriers, not available to over 99% of all other agents.

Because there can be as much as a 30% to 43% difference in payouts among the top carriers, clients may realize a difference of thousands of dollars of income annually by working with Steve—potentially hundreds of thousands over time.

A financial plan built for this century, not the last one.

“Once upon a time, CDs and bonds paid 5% to 9%. Retirement was simple. Planning was easier. But that was then — this is now! Is your financial plan built for where you’ve been, or where you and your spouse are going? Through thoughtful planning, careful calculation and a lot of listening, we can help you build a solid foundation for a more stress-free retirement! Yes, you can enjoy ample income that won’t let you down, liquidity that keeps your lifestyle intact, simplicity that leads to peace of mind and protection of principal while indexing for growth to keep you moving forward. With over 20 years of successful service advising clients, I know I can help you make the right annuity choice and can help you with your entire financial plan. Learn why I reject more than 98% of all annuities. Let's talk soon.”

Let's talk soon

Listen to Steve’s Radio Show, “Mastering Money”

Tune in to MASTERING MONEY, with Best-Selling Author Steve Jurich and Ken Morgan, Monday – Friday from 8am to 9am and 11am to 12 NOON, or download our FREE App on your app store--listen any time, and call us any time. We are here to help make your retirement more simple, safe, and secure.